When people talk about art value, it usually comes down to price. But if you’ve spent time around art talking to artists, collectors, or galleries, you know it’s never that simple. Some works hold their value for decades. Others don’t, and it’s not always clear why.

So where does art value really come from? Is it shaped by the artist, reinforced by galleries, sustained by collectors, or defined by the market?

Let’s look at how art value is built and sustained over time, and why it has more to do with people, relationships, and long-term thinking than quick sales or trends.

I. Why Art Is Seen as a Financial Asset

Art is increasingly discussed as a form of investment because, under certain conditions, it can preserve and grow value over long periods. This perspective appears in academic research as well as in financial advisory literature that examines art as an asset class, particularly in relation to wealth preservation, portfolio diversification, and cultural capital.

Research by Joanna Białynicka-Birula has shown that artworks can function as long-term assets, but with significant differences from traditional financial instruments, including higher risk, illiquidity, and non-linear returns. Similarly, studies by Andrew C. Worthington and Helen Higgs demonstrate that art market returns are heavily dependent on long time horizons and broader economic conditions, rather than short-term trading behavior

From a financial advisory perspective, Citrin Cooperman’s guide to investing in art explains why artworks are often viewed as assets capable of retaining value across generations—while emphasizing that outcomes depend on informed decision-making, context, and patience.

This is where misunderstandings often arise.

Recognizing art as a potential investment does not mean value is automatic, predictable, or guaranteed. Financial potential exists—but it is built, not assumed. And it depends on far more than resale timing or market trends.

This leads to a more fundamental question: how is artistic value actually created and sustained?

II. Value Is Not Singular—It Is Collective

Artistic value is often discussed as if it belongs to one party alone—typically the artist, sometimes the market. In reality, value is not owned by any single actor. It is maintained through an ecosystem.

The artist generates meaning, direction, and creative continuity

The gallery contextualizes, protects, and stabilizes the practice

The collector sustains value through long-term engagement

The market reflects value—but does not define it

Price exists in the marketplace. Value exists in time.

Prices may rise or fall quickly in response to demand or economic conditions. Value, by contrast, deepens through continuity, care, and context. Understanding this distinction is essential for anyone interested in building value rather than reacting to numbers.

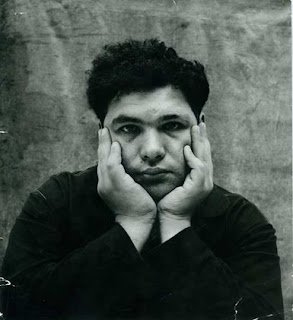

III. The Artist’s Role: Responsibility, Purpose, and Renewal

An artist’s responsibility does not end when a work leaves the studio. In many ways, this is where value-building begins.

A strong artistic practice is marked by continuous intellectual renewal: the willingness to question, experiment, and move beyond comfort zones. Artists who sustain value over time are rarely driven primarily by market trends or immediate economic reward. Their work is oriented toward exploration, disruption, and, at times, the creation of entirely new visual or conceptual frameworks.

Here, artistic responsibility becomes inseparable from value.

Phan Ling Gallery

An artist’s name remains permanently attached to what they create. Reputation, ethics, and decision-making shape how work is perceived long after it enters the world. Choices around exhibition frequency, collaboration, production volume, and market exposure all influence long-term perception. Overproduction or poorly considered visibility can dilute meaning and weaken value.

Artists with purpose understand that value is cumulative—and fragile. Their role is not only to create work, but to protect the integrity of what that work represents.

IV. The Gallery’s Role: Context, Protection, and Stewardship

Galleries play a critical role in sustaining value beyond the point of sale.

This includes maintaining pricing consistency, avoiding abrupt market distortions, and placing works with collectors who understand long-term stewardship. Equally important is the gallery’s role in providing context, historical, cultural, and conceptual, so artworks are not detached from the ideas that give them meaning.

Institutions such as MoMA have long emphasized how an artist’s methods, materials, and conceptual frameworks shape the way work is understood over time.

At Phan Ling Gallery, this understanding shapes how we approach our role within the art ecosystem. We see the gallery not as a point of transaction, but as a long-term steward—one responsible for protecting artistic intent, supporting sustainable practices, and building thoughtful relationships between artists and collectors. This means prioritizing context over speed, continuity over visibility, and care over volume.

Educational, value-driven galleries focus less on transactions and more on long-term confidence. Their responsibility is to protect both the artist’s practice and the collector’s trust over time, rather than chase short-term attention or sales metrics.

In this sense, a gallery functions less as a marketplace and more as a steward of artistic ecosystems.

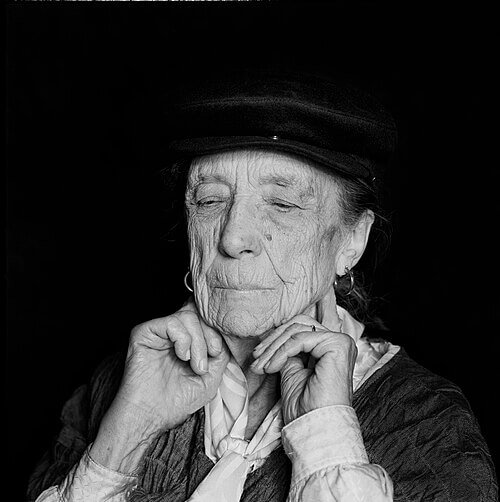

V. The Collector’s Responsibility in Artistic Value

The journey of art investment does not begin after a purchase, when resale becomes a consideration. It begins much earlier, at the stage of artist selection and it continues through the role the collector chooses to play.

Art investment is not about buying and selling objects.

It is about investing in people, and participating in the ecosystem that sustains their work.

Collectors are not passive holders of value. They are an active part of how value is built, protected, and carried forward over time. The choices they make—what they acquire, how long they hold, how they speak about the work, and whether they engage beyond ownership—all influence an artist’s long-term trajectory.

Seasoned collectors understand this instinctively. Many are not simply buyers, but long-term supporters—and often close confidants—of the artists they collect. They follow an artist’s development, support their work through different phases, and contribute to the conditions that allow meaningful practices to continue.

Seen this way, collecting becomes a relationship, not a transaction.

Phan Ling Gallery

Thinking long-term means viewing an artist not as a speculative asset, but as a creative partner within a shared ecosystem. This requires looking beyond the surface of the work and considering:

The artist’s work ethic and consistency

Their values, motivations, and decision-making

How personal, social, and historical contexts shape their practice

How their ideas evolve over time

Informed collectors build knowledge alongside relationships. They understand that an artist’s life, context, and decisions all influence the work that enters the world—and, by extension, its long-term value.

Within a healthy ecosystem, collectors do not extract value; they help sustain it.

VI. The Market: What You Cannot Control

No artist, collector, or gallery controls the market.

Economic cycles, cultural shifts, and changing demand affect all assets, including art. Unlike financial instruments, art markets move slowly and unevenly. Value is not always immediately reflected, nor is it linear.

As highlighted in broader cultural–economic analysis by The Art Basel & UBS Global Art Market Report, market visibility does not always correlate with long-term value.

Understanding this helps set realistic expectations. The market responds to value—it does not create it.

VII. Value Continues After the Purchase

Buying art is not the end of the journey. It is the beginning.

Value grows through time, care, understanding, and shared commitment among artists, galleries, and collectors. Works that continue to speak—emotionally, intellectually, and culturally—outlast market noise.

When value is approached as a collective effort rather than a transaction, art retains its deepest strength: the ability to matter long after prices are forgotten.